2017 Top Ten Workers’ Compensation Fraud Cases

by Leonard T. Jernigan, Jr.

Raleigh, N.C.

| Non-Employee Fraud Cases – 10 | $ | 697.4 | Million | |

| Employee Fraud Cases – 0 | $ | 0 | ||

| Total Fraud | $ | 697.4 | Million |

Seven of the top ten cases in 2017 are from California, two from Texas, and one from Tennessee.

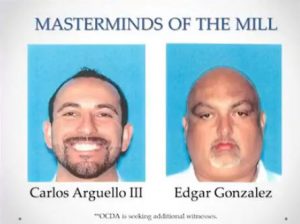

- (CA) 10 Attorneys, 6 Others Charged by O.C. District Attorney’s Office in What it Calls a Massive Workers’ Comp Scheme (6/5/17)

Ten attorneys and six others were indicted in a $300 million workers’ comp scheme where the attorneys agreed to contract with companies run by Carlos Arguello III and Edgar Gonzalez in return for employees, known as cappers, to deliver the attorneys a minimum number of clients per month. The cappers were not attorneys and would have prospective clients sign legal papers without any contact or input from the actual attorneys. Because the use of cappers is illegal, all of the insurance payouts are considered part of the fraud ring.

- (TX) Federal Grand Jury Indicts Eight Individuals Charged in a $158 Million Health Care Fraud Scheme (3/25/17)

A federal grand jury indicted eight individuals for their involvement in a health care fraud scheme. Jamshid Noryian marketed creams used to treat scars, wounds, and pain to doctors treating Department of Labor – Office of Workers’ Compensation Programs patients and induced the doctors to prescribe these medications to pharmacies operated by Ashraf Mofid, Christopher Rydberg, and Leyla Nourian in exchange for payments, free rent, and other inducements. Approximately $158 million in false and fraudulent claims were submitted and approximately $82 million as payment for those claims were received.

- (CA) Three Men Convicted of Defrauding Over $70 Million from Workers’ Compensation Insurance Carriers in Overbilling Scheme (5/8/17)

Jeffrey Edward Campau, Landen Alan Mirallegro, and Abraham Khorshad were convicted in an overbilling scheme. The three men formed a durable medical equipment company, Aspen Medical Resources, LLC, in 2005. Between 2005 and 2013, the company rented out a hot/cold durable medical equipment machine that helped alleviate inflammation and/or pain for patients. The company overbilled insurance carriers by renting out the one machine, valued less than $500, as two separate hot and cold machines for as much as $18,000. The company submitted $70 million worth of claims for the units.

- (CA) DIR and Division of Workers’ Compensation Suspend Seven Providers for Fraud (2/16/17)

Seven medical providers were suspended after filing more than 8,500 liens with a total claim value of at least $59 million. The suspended providers were engaged in different types of fraud related to the workers’ compensation liens ranging from mail fraud, kickback schemes, and referral of patients for unnecessary care.

- (CA) Massive Workers’ Comp Ring Uncovered in California (4/21/17)

More than 13,000 patients and 27 insurers were victims of a complex insurance fraud scheme run by Tanya Moreland King and Christopher King involving more than two dozen doctors, pharmacists, and business owners. The Kings recruited doctors and pharmacists to prescribe unnecessary treatment for workers’ compensation patients including prescribing compound creams that are not approved by the U.S. Food and Drug Administration and are not known to have any medical benefits. The Kings would purchase the creams for between $15 and $40 per tube and bill the insurers for between $250 and $700 per tube. More than $40 million was billed to insurers.

- (CA) Bay Area Business Owner Arrested in $32 Million Workers’ Comp Fraud Scheme (6/1/17)

Gina Marie Gregori, the owner of three companies in California, was arrested for falsifying documents and underreporting payroll to her workers’ compensation insurance company over a seven-year period. She was charged with 19 felony counts and allegedly ripped off insurers to the tune of $32 million.

- (TN) Powell Woman in $15.8m Fraud Case Sentenced to 8 Years in Federal Prison (9/21/17)

Andrea Ball Rudd, the owner of HR Comp, LLC, stole $10.4 million in payroll tax money and $5.4 million in workers’ compensation insurance premiums from small businesses. She was ordered to pay $15,776,417 in restitution and sentenced to 8 years in prison for tax evasion and mail and wire fraud after she pleaded guilty to the charges in April.

- (TX) Siblings Indicted in Workers’ Compensation Fraud and Kickback Scheme (11/15/17)

Anukul “Andy” Dass and his sister Anurag “Anna” Dass, the operators of A & A Pain in Wellness Center, are accused of filing $9.1 million in false claims with the Federal Office of Worker Compensation Programs from 2010 to 2017. The false claims were filed for services that were not performed or were “upcoded” and billed at a higher rate than the services that were actually performed.

- (CA) Company Owners Plead Guilty in $7 Million San Diego Hotel-Worker Fraud Case (4/9/17)

Hyok “Steven” Kwon and his wife, Woo “Stephanie” Kwon hid the existence of at least 800 housekeeping and janitorial workers to avoid paying workers’ compensation insurance rates and payroll taxes. They pleaded guilty to charges related to fraud and employment tax evasion. Steven was sentenced to eight years in prison and Stephanie was sentenced to six years and eight months in jail and probation.

- (CA) East Bay Restaurant Owners Plead Guilty (6/6/17)

Eight owners and managers of four Asian restaurants faced 28 charges including conspiracy, wage theft, and workers’ compensation fraud after they failed to pay their workers minimum wage and pay correct workers’ compensation premiums. Investigators estimate that they committed $4.5 million in wage theft from 2009-2013, and cheated California out of another $2 million in taxes. Five of the defendants pleaded guilty to some of the charges, while three others fled to China.

For further information, contact:

Leonard T. Jernigan, Jr.

The Jernigan Law Firm

3105 Glenwood Avenue, Suite 300

Raleigh, NC 27612

(919) 833-0299

jes@jernlaw.com